When it comes to building and customizing your dream home, it’s easy to get caught up in exciting ideas and trends. However, not all choices are created equal, especially when it comes to landscaping. One seemingly harmless decision, like planting a multitude of fruit trees, can lead to unexpected challenges down the road. In this blog post, we’ll explore some common landscaping mistakes that can negatively impact your home’s resale value and provide insights on how to avoid them.

The Fruit Tree Fiasco: A Sour Surprise

Picture this: a picturesque backyard adorned with vibrant fruit trees, a paradise for anyone with a green thumb. However, before you embark on an orchard adventure, consider the long-term implications. While fruit trees may seem charming initially, they can become a burden over time.

1. The Messy Reality:

As fruit trees mature, they bear fruit – and lots of it. What starts as a picturesque scene can quickly turn into a mess of fallen fruit. This can become a nuisance, especially if you’re away during peak fruiting season. Imagine returning from a summer vacation to a yard covered in fallen fruit, requiring extra time, effort, and potentially hiring someone to clean up.

2. Neighborly Concerns:

While it might seem neighborly to have fruit trees that overhang your property line, it’s important to consider your neighbors’ perspective. Overgrown trees can encroach on neighboring yards, potentially leading to conflicts over falling fruit, potential damage, and even disputes about boundaries.

3. Space and Scale:

In the excitement of landscaping, it’s easy to underestimate the eventual size of trees. Fruit trees can grow much larger than expected, leading to overcrowding and overshadowing of your yard. Proper spacing is essential to avoid a cramped and cluttered appearance, especially in smaller yards where space is limited.

A Wiser Alternative: Choosing Prudent Landscaping

To enhance your home’s appeal without compromising your future resale value, here are a few alternatives to consider:

1. Ornamental Trees:

Opt for smaller, ornamental trees that provide beauty without the excessive fruit production. These trees are generally easier to maintain and won’t create the same mess as fruit-bearing trees.

2. Well-Planned Design:

Consult with a professional landscaper to design a yard that is both visually appealing and functional. Proper spacing, balanced plant selection, and a thoughtful layout can make a significant difference in your home’s curb appeal.

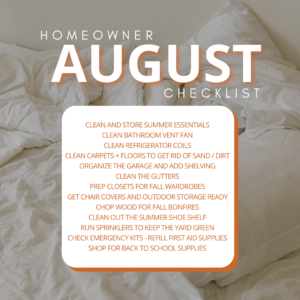

3. Low-Maintenance Landscaping:

Consider drought-resistant plants and landscaping features that require minimal maintenance. A well-maintained yard is more likely to attract potential buyers.

While the allure of a backyard orchard might be tempting, it’s crucial to weigh the long-term consequences. Landscaping choices can greatly impact your home’s resale value, so it’s essential to strike a balance between aesthetics and practicality. By avoiding the fruit tree fiasco and making informed landscaping decisions, you’ll ensure that your home remains a valuable asset for years to come. Remember, a well-thought-out landscape not only enhances your living experience but also contributes positively to your property’s market appeal.

For more Real Estate advices, contact us @ SHEA PREFERRED REALTY