Heard about the “Silver Tsunami” lately?

While some fear a sudden flood of baby boomers selling their homes could disrupt the housing market, let’s set the record straight.

Not all baby boomers plan to move!

More than half want to stay put, aging gracefully in their own homes.

And for those who do sell, it won’t happen all at once.

The transition will be gradual, spanning over many years.

Whether you’re considering downsizing or staying put, we’ve got you covered.

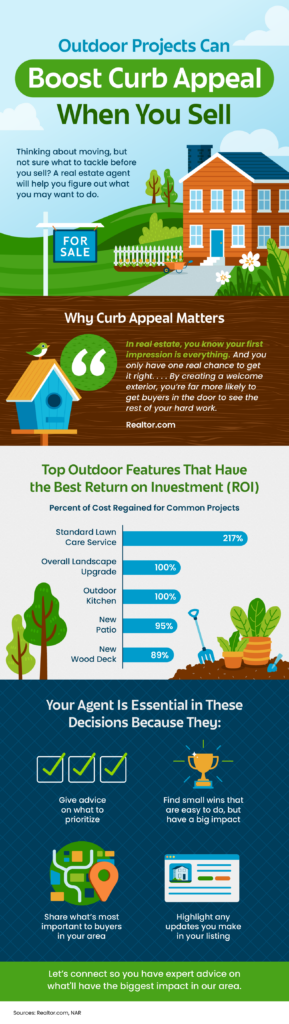

Reach out to us if you’re thinking about selling your home and want expert guidance every step of the way.