Did you know that with the Encanterra Living app, you can do more than just connect with trusted trade partners?

⠀⠀⠀⠀⠀⠀⠀⠀⠀

You can also browse homes listed in the MLS, including those right here at Encanterra!

⠀⠀⠀⠀⠀⠀⠀⠀⠀

Stay in the know about real estate opportunities in our community and receive alerts for upcoming open houses and more.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

Don’t miss out on this valuable resource – download the Encancterra Living app today!

⠀⠀⠀⠀⠀⠀⠀⠀⠀

Scan the QR code or find us in the App Store.

The Secret to Success

Ever wonder what sets successful realtors apart? It’s not just about saying what sellers want to hear.

BE HONEST

In Real Estate, honesty is key. We believe sellers deserve clear guidance, even when it’s tough. From decluttering to staging, we’re here to provide honest advice every step of the way.

THE HARD TRUTH

We believe in providing clear guidance to our clients, even if it means delivering tough truths.

Looking for a Realtor? Message us! @SHEA PREFERRED REALTY GROUP

Why Pre-Approval is More Important this Year

Why Pre-Approval Is Even More Important This Year

On the road to becoming a homeowner? If so, you may have heard the term pre-approval get tossed around. Let’s break down what it is and why it’s important if you’re looking to buy a home in 2024.

What Pre-Approval Is

As part of the homebuying process, your lender will look at your finances to figure out what they’re willing to loan you. According to Investopedia, this includes things like your W-2, tax returns, credit score, bank statements, and more.

From there, they’ll give you a pre-approval letter to help you understand how much money you can borrow. Freddie Mac explains it like this:

“A pre-approval is an indication from your lender that they are willing to lend you a certain amount of money to buy your future home. . . . Keep in mind that the loan amount in the pre-approval letter is the lender’s maximum offer. Ultimately, you should only borrow an amount you are comfortable repaying.”

Now, that last piece is especially important. While home affordability is getting better, it’s still tight. So, getting a good idea of what you can borrow can help you really wrap your head around the financial side of things. It doesn’t mean you should borrow the full amount. It just tells you what you can borrow from that lender.

This sets you up to make an informed decision about your numbers. That way you’re able to tailor your home search to what you’re actually comfortable with budget-wise and can act fast when you find a home you love.

Why Pre-Approval Is So Important in 2024

If you want to buy a home this year, there’s another reason you’re going to want to be sure you’re working with a trusted lender to make this a priority.

While more homes are being listed for sale, the overall number of available homes is still below the norm. At the same time, the recent downward trend in mortgage rates compared to last year is bringing more buyers back into the market. That imbalance of more demand than supply creates a bit of a tug-of-war for you.

It means you’ll likely find you have more competition from other buyers as more and more people who were sitting on the sidelines when mortgage rates were higher decide to jump back in. But pre-approval can help with that too.

Pre-approval shows sellers you mean business because you’ve already undergone a credit and financial check. As Greg McBride, Chief Financial Analyst at Bankrate, says:

“Preapproval carries more weight because it means lenders have actually done more than a cursory review of your credit and your finances, but have instead reviewed your pay stubs, tax returns and bank statements. A preapproval means you’ve cleared the hurdles necessary to be approved for a mortgage up to a certain dollar amount.”

Sellers love that because that makes it more likely the sale will move forward without unexpected delays or issues. And if you may be competing with another buyer to land your dream home, why wouldn’t you do this to help stack the deck in your favor?

Bottom Line

If you’re looking to buy a home in 2024, know that getting pre-approved is going to be a key piece of the puzzle. With lower mortgage rates bringing more buyers back into the market, this can help you make a strong offer that stands out from the crowd.

Planning to make a move this year? Don’t hesitate to message us! @ SHEA PREFERRED REALTY GROUP

Realtor’s Key to Success

Watch our Instagram Reels here

Ever wondered what makes a realtor truly successful?

Ever wondered what makes a realtor truly successful?

It’s not just about saying what sellers want to hear. Sometimes, it’s about telling them what they don’t want to hear.

Honesty is our secret weapon, and it’s what sets us apart.

Reach out to us if you are looking for a realtor who will be transparent throughout the process of selling your home. @ SHEA PREFERRED REALTY GROUP

Home Equity Can Be a Game Changer When You Sell

Are you on the fence about selling your house? While affordability is improving this year, it’s still tight. And that may be on your mind. But understanding your home equity could be the key to making your decision easier. An article from Bankrate explains:

“Home equity is the difference between your home’s value and the amount you still owe on your mortgage. It represents the paid-off portion of your home.

You’ll start off with a certain level of equity when you make your down payment to buy the home, then continue to build equity as you pay down your mortgage. You’ll also build equity over time as your home’s value increases.”

Think of equity as a simple math equation. It’s the value of your home now minus what you owe on your mortgage. And guess what? Recently, your equity has probably grown more than you think.

In the past few years, home prices skyrocketed, which means your home’s value – and your equity – likely shot up, too. So, you may have more equity than you realize.

How To Make the Most of Your Home Equity Right Now

If you’re thinking about moving, the equity you have in your home could be a big help. According to CoreLogic:

“. . . the average U.S. homeowner with a mortgage still has more than $300,000 in equity . . .”

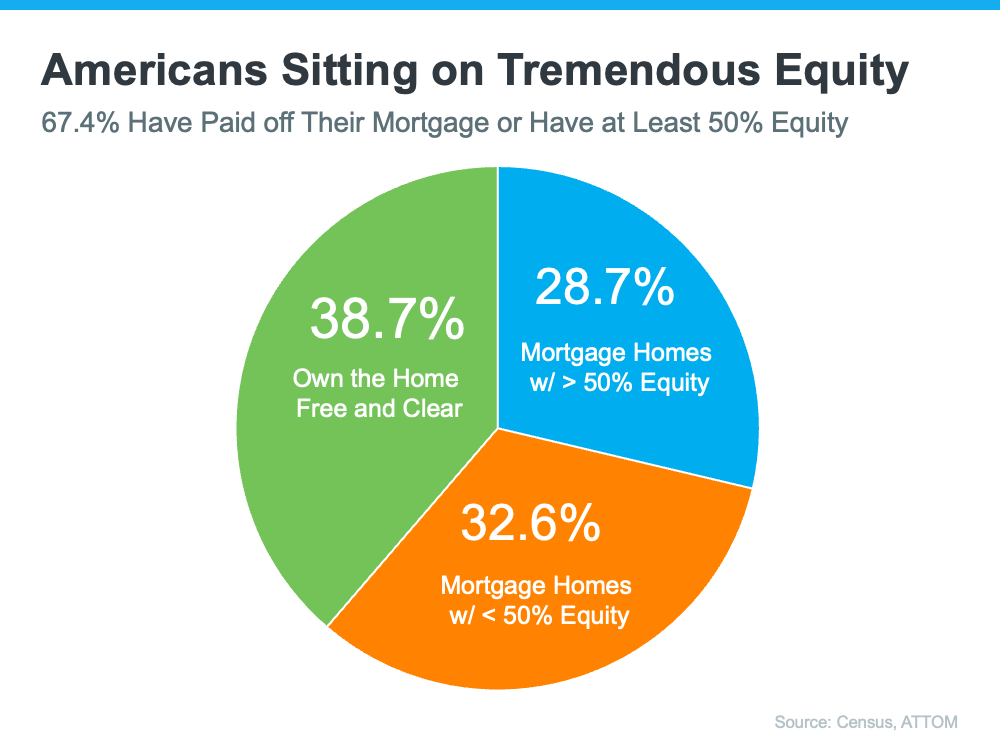

Clearly, homeowners have a lot of equity right now. And the latest data from the Census and ATTOM shows over two-thirds of homeowners have either completely paid off their mortgages (shown in green in the chart below) or have at least 50% equity (shown in blue in the chart below):

That means roughly 70% have a tremendous amount of equity right now.

After you sell your house, you can use your equity to help you buy your next home. Here’s how:

- Be an all-cash buyer: If you’ve been living in your current home for a long time, you might have enough equity to buy your next home without having to take out a loan. If that’s the case, you won’t need to borrow any money or worry about mortgage rates. Investopedia states:

“You may want to pay cash for your home if you’re shopping in a competitive housing market, or if you’d like to save money on mortgage interest. It could help you close a deal and beat out other buyers.”

- Make a larger down payment: Your equity could also be used toward your next down payment. It might even be enough to let you put a larger amount down, so you won’t have to borrow as much money. The Mortgage Reports explains:

“Borrowers who put down more money typically receive better interest rates from lenders. This is due to the fact that a larger down payment lowers the lender’s risk because the borrower has more equity in the home from the beginning.”

The Easy Way To Find Out How Much Equity You Have

To find out how much equity you have in your home, ask a real estate agent you trust for a Professional Equity Assessment Report (PEAR).

Bottom Line

Planning a move? Your home equity can really help you out. Let’s connect to see how much equity you have and how it can help with your next home. Message us anytime @ SHEA PREFERRED REALTY GROUP

How Important is a Floor Plan?

Watch our Instagram video here!

When it comes to finding your dream home, don’t underestimate the power of a well-thought-out floor plan.

Imagine your daily life in this space – envision comfort, practicality, and room to grow!

Take a moment to reflect: Can you picture yourself living seamlessly in each room? Does it align with your lifestyle and future plans?

Now, we’re curious! What type of floor plan resonates with you? Drop a comment in our Instagram post – we’d love to hear your preferences!

Avoid HOA Hassles

Learn from our experience! About six months ago, we faced a potential hiccup in a transaction—all because of a backyard hot tub.

HOA Inspection Surprise: During escrow, the HOA inspected the home’s exterior, discovering a hot tub violation. The spa lacked a required wall, putting the sale at risk.

Seller’s Dilemma: The sellers received a notice threatening fines if they didn’t address the hot tub issue promptly. The problem could have become the buyer’s, leading to potential closing delays.

Costly Consequences: To avoid complications, the sellers had to invest thousands to meet HOA requirements and prevent a closing delay. Don’t let minor changes turn into major headaches. Get HOA approval upfront!

For more Real Estate advice and tips, don’t hesitate to message us! @ SHEA PREFERRED REALTY GROUP

Ask for HOA Permission First

A recent transaction taught us a valuable lesson about HOA approval for yard changes.

Avoid costly mistakes and potential delays during the home-selling process.

Stay informed and ensure compliance with community standards.

Ready to sell without unnecessary hassles? Reach out for expert guidance!

Boost Your Curb Appeal

Boosting your curb appeal goes beyond the basics! Elevate your outdoor game with these three additions:

Illuminate Walkways: Impress potential buyers with ambient outdoor lighting. (Pro tip: Solar lights are a game-changer.)

Upgrade Porch Lights: Swap out outdated lights for a fresh, modern look. It’s a quick, easy DIY project.

Outdoor Pillows for Seating: Create a dreamy outdoor space that buyers can envision themselves enjoying.

Ready to enhance your home’s appeal? Drop a comment if you have any other tips.

3 MUST DO’S When Selling Your Home

Planning to make a move this year?

Whether you’re buzzing with excitement for the next chapter or feeling a bit sentimental about your current home, finding the right balance is key.

The housing market has shifted, and pricing your home correctly is crucial. Avoid deterring buyers by setting a competitive price. An experienced real estate agent, like us, can help determine the ideal asking price, ensuring your house sells quickly and for top dollar.

2. Keep Your Emotions in Check

Homeowners are staying in their homes longer, increasing emotional attachment. Trust your realtor to navigate negotiations and establish the best pricing strategy. Their expertise ensures a fair market price while considering your sentimental connection.

3. Stage Your Home Properly

Create a broad appeal by focusing on your home’s first impression. Buyers want to envision themselves in the space, so neutralize decor and personalize touches. Home staging showcases your property in the best light, attracting more potential buyers.

With these three best practices, you’ll feel confident and ready to take on the journey. Let’s chat about your plans and ensure you navigate the process smoothly. Message us @SHEA PREFERRED REALTY GROUP