Where Are Mortgage Rates Headed?

There’s never been a truer statement regarding forecasting mortgage rates than the one offered last year by Mark Fleming, Chief Economist at First American:

“You know, the fallacy of economic forecasting is: Don’t ever try and forecast interest rates and or, more specifically, if you’re a real estate economist mortgage rates, because you will always invariably be wrong.â€

Coming into this year, most experts projected mortgage rates would gradually increase and end 2022 in the high three-percent range. It’s only April, and rates have already blown past those numbers. Freddie Mac announced last week that the 30-year fixed-rate mortgage is already at 4.72%.

Danielle Hale, Chief Economist at realtor.com, tweeted on March 31:

“Continuing on the recent trajectory, would have mortgage rates hitting 5% within a matter of weeks. . . .â€

Just five days later, on April 5, the Mortgage News Daily quoted a rate of 5.02%.

No one knows how swiftly mortgage rates will rise moving forward. However, at least to this point, they haven’t significantly impacted purchaser demand. Ali Wolf, Chief Economist at Zonda, explains:

“Mortgage rates jumped much quicker and much higher than even the most aggressive forecasts called for at the end of last year, and yet housing demand appears to be holding steady.â€

Through February, home prices, the number of showings, and the number of homes receiving multiple offers all saw a substantial increase. However, much of the spike in mortgage rates occurred in March. We will not know the true impact of the increase in mortgage rates until the March housing numbers become available in early May.

Rick Sharga, EVP of Market Intelligence at ATTOM Data, recently put rising rates into context:

“Historically low mortgage rates and higher wages helped offset rising home prices over the past few years, but as home prices continue to soar and interest rates approach five percent on a 30-year fixed rate loan, more consumers are going to struggle to find a property they can comfortably afford.â€

While no one knows exactly where rates are headed, experts do think they’ll continue to rise in the months ahead. In the meantime, if you’re looking to buy a home, know that rising rates do have an impact. As rates rise, it’ll cost you more when you purchase a house. If you’re ready to buy, it may make sense to do so sooner rather than later.

Bottom Line

Mark Fleming got it right. Forecasting mortgage rates is an impossible task. However, it’s probably safe to assume the days of attaining a 3% mortgage rate are over. The question is whether that will soon be true for 4% rates as well.

Do You Know How Much Equity You Have In Your Home?

Do you know how much equity you have in your home? If you’re a homeowner, your net worth has gotten a big boost. That’s because recent home price appreciation has increased your equity! Here’s what you need to know.

What Is Equity?

Equity is the current value of your home minus what you owe on the loan. It increases when:

- You pay down your loan over time

- Home price appreciation drives up your home’s value

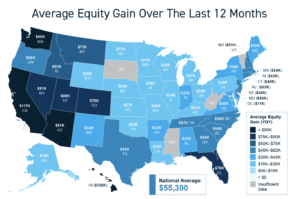

Since this time last year, homeowners have seen RAPID equity growth and that average grew by $55,300.

How does this benefit you?

You can use rising home equity to fuel a move. It may be some (if not all) of what you need for a down payment on your next home! Want to talk about how you can take advantage of this? Contact us today!

How’s the Encanterra Market for April 2022?

Encanterra Market Report March 2022

As reported by the ARMLS 4/1/2022

Current active listings: 9

Current under contract listings: 21

Current coming soon listings: 1

Still have questions? Or want to know your home’s value? Contact us today! We would be happy to discuss this or any other questions with you.

How Much Did The Average Homeowner Gain In Equity Over The Past Year?

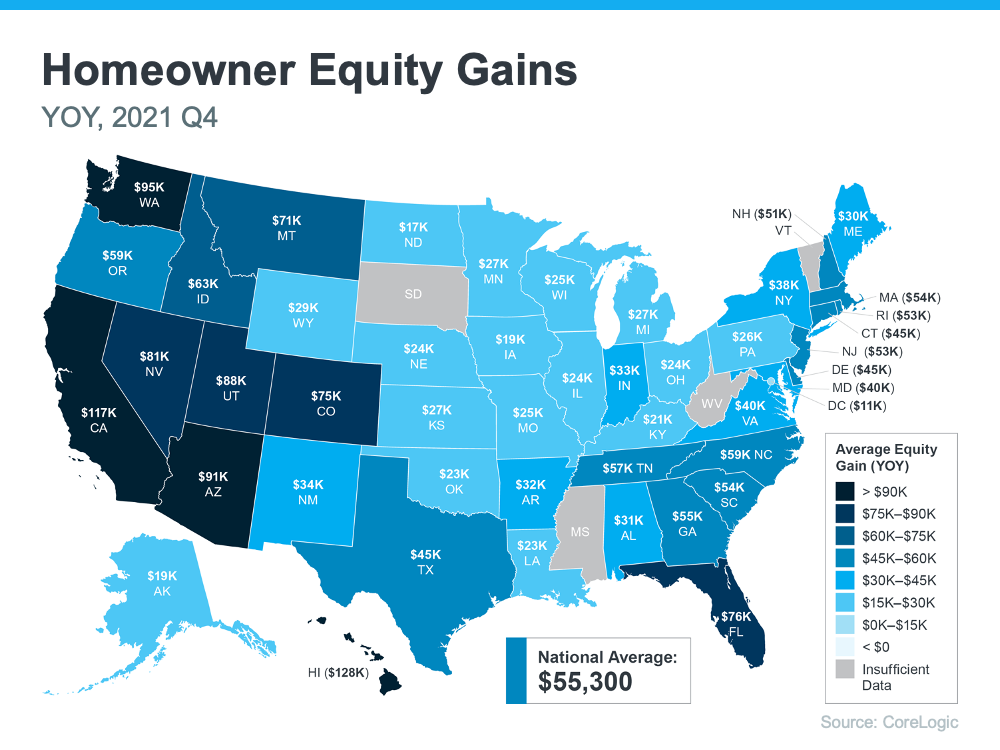

The Average Homeowner Gained More Than $55K in Equity over the Past Year

If you’re a current homeowner, you should know your net worth just got a big boost. It comes in the form of rising home equity. Equity is the current value of your home minus what you owe on the loan. Today, you’re building that equity far faster than you may expect – and this gain is great news for you.

Here’s how it happened. Home values are on the rise thanks to low housing supply and high buyer demand. Basically, there aren’t enough homes available to meet this high buyer interest, so bidding wars are driving home prices up. When you own a home, the rising prices mean your home is worth more in today’s market. And as home values climb, your equity does too. As Dr. Frank Nothaft, Chief Economist at CoreLogic, explains:

“Home prices rose 18% during 2021 in the CoreLogic Home Price Index, the largest annual gain recorded in its 45-year history, generating a big increase in home equity wealth.â€

The latest Homeowner Equity Insights from CoreLogic shed light on just how much rising home values have boosted homeowner equity. According to that report, the average homeowner’s equity has grown by $55,300 over the last 12 months.

Want to know what’s happening in your area? Here’s a breakdown of the average year-over-year equity growth for each state based on that data.

How Rising Equity Impacts You

In addition to building your overall net worth, equity can also help you achieve other goals like buying your next home. It works like this: when you sell your house, the equity you built up comes back to you in the sale.

In a market where you’re gaining so much equity, it may be just what you need to cover a large portion – if not all – of the down payment on your next home. So, if you’ve been holding off on selling and worried about being priced out of your next home because of today’s home price appreciation, rest assured your equity can help fuel your move.

Bottom Line

Equity can be a real game-changer if you’re planning to make a move. To find out just how much equity you have in your home and how you can use it to fuel your next purchase, let’s connect so you can get a professional equity assessment report on your house.

How’s the Encanterra Market for March 2022?

Encanterra Market Report March 2022

As reported by the ARMLS 3/19/2022

Current active listings: 7

Current under contract listings: 21

Current coming soon listings: 1

Still have questions? Or want to know your home’s value? Contact us today! We would be happy to discuss this or any other questions with you.

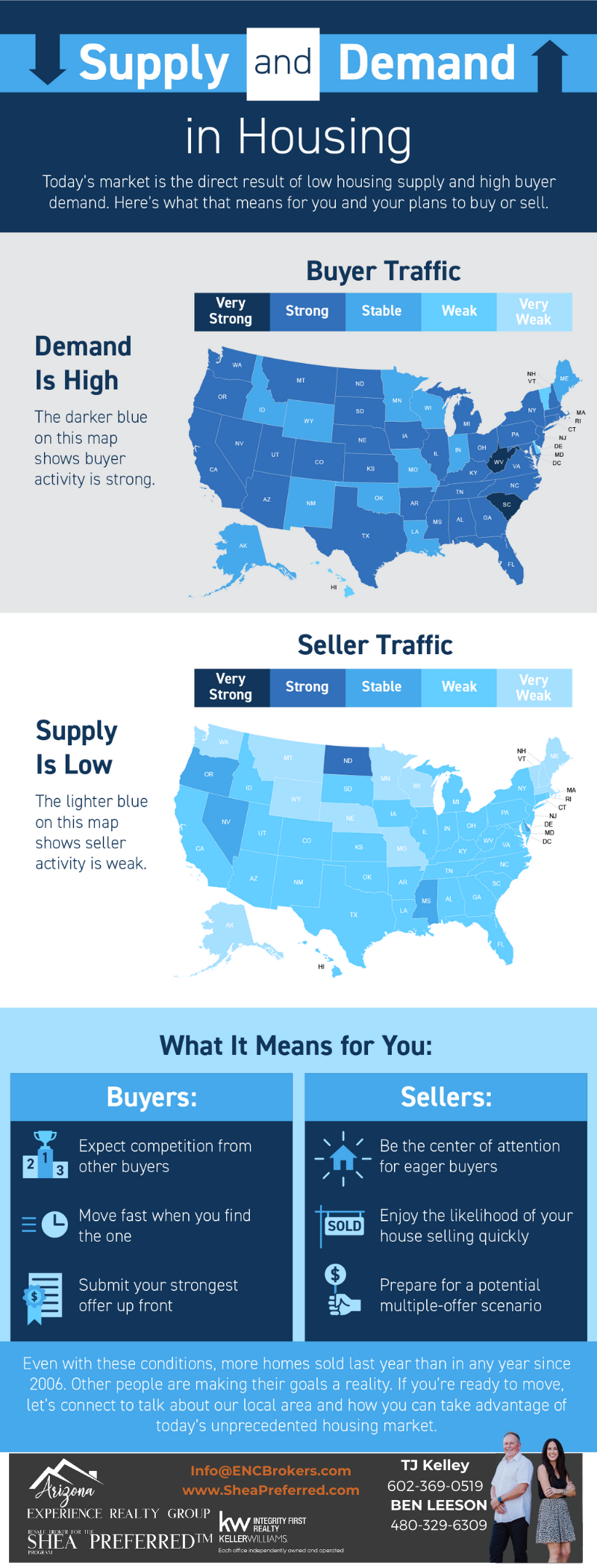

Supply vs Demand in Housing

Even with these conditions, more homes sold last year than in any year since 2006. Other people are making their goals a reality. If you are ready to make a move, let’s connect to talk about our local area and how you can take advantage of today’s unprecedented housing market!

How Global Uncertainty Is Impacting Mortgage Rates

How Global Uncertainty Is Impacting Mortgage Rates

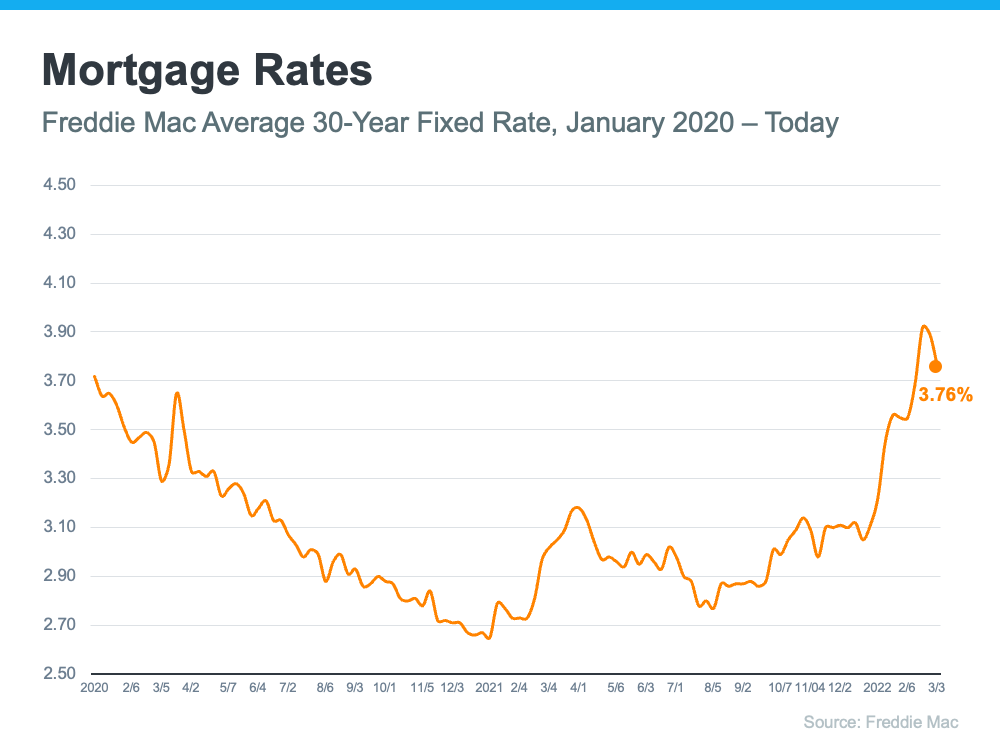

If you’re thinking about buying or selling a home, you’ll want to keep a pulse on what’s happening with mortgage rates. Rates have been climbing in recent months, especially since January of this year. And just a few weeks ago, the 30-year fixed mortgage rate from Freddie Mac approached 4% for the first time since May of 2019. But that climb has dropped slightly over the past few weeks (see graph below):

The recent decline in mortgage rates is primarily due to growing uncertainty around geopolitical tensions surrounding Russia and Ukraine. But experts say it’s to be expected.

Here’s a look at how industry leaders are explaining the impact global uncertainty has on mortgage rates:

Odeta Kushi, Deputy Chief Economist at First American, says:

“While mortgage rates trended upward in 2022, one unintended side effect of global uncertainty is that it often results in downward pressure on mortgage rates.â€

In another interview, Kushi adds:

“Geopolitical events play an important role in impacting the long end of the yield curve and mortgage rates. For example, in the weeks following the ‘Brexit’ vote in 2016, the U.S. Treasury bond yield declined and led to a corresponding decline in mortgage rates.â€

Kushi’s insights are a reminder that, historically, economic uncertainty can impact the 10-year treasury yield – which has a long-standing relationship with mortgage rates and is often considered a leading indicator of where rates are headed. Basically, events overseas can have an impact on mortgage rates here, and that’s what we’re seeing today.

Will Mortgage Rates Stay Down?

While no one has a crystal ball to predict exactly what will happen with rates in the future, experts agree this slight decline is temporary. Sam Khater, Chief Economist at Freddie Mac, echoes Kushi’s sentiment, but adds that the decline in rates won’t last:

“Geopolitical tensions caused U.S. Treasury yields to recede this week . . . leading to a drop in mortgage rates. While inflationary pressures remain, the cascading impacts of the war in Ukraine have created market uncertainty. Consequently, rates are expected to stay low in the short-term but will likely increase in the coming months.â€

Rates will likely fluctuate in the short-term based on what’s happening globally. But before long, experts project rates will renew their climb. If you’re in the market to buy a home, doing so before rates start to rise again may be your most affordable option.

Bottom Line

Mortgage rates are an important piece of the puzzle because they help determine how much you’ll owe on your monthly mortgage payment in your next home. Let’s connect so you have up-to-date information on rates and trusted advice on how to time your next move.

February 2022 | Encanterra® Real Estate Market Update

Here is a overall look at the Real Estate Market for February in Encanterra & surrounding areas.

Statistics are year over year & figures come directly from the MLS.

As of today there are:

13 active listings

17 under contract listings

1 coming soon listing

3 closed listings

Give us a call today to see what your home is worth!

Current State of Real Estate Companies in Today’s Market…

As most of you already know, TJ and I work onsite at Encanterra in the resale office model gallery. We run a business open every day with staff, employees, etc. I’ve personally been involved with RE at the highest level for 30 years. The info below (very long) is very worth reading and follows what I believe has been happening for 3-4 years and likely helping to artificially inflate property values. Yes this may seem like a win for the consumer. They get one of the hundreds of people and companies to buy their house as is, move out, make a profit and move on. The numbers below are staggering and we have seen this at Encanterra numerous times. A current listing here with one of the Infomercial companies has a listing that has reduced its price by $80k for a smaller home in 30 days. Perhaps if the owners knew the agent had the community as Anthem at Merrill Ranch, an $80k price reduction would not be necessary. The losses in the billions for these major companies should worry all of us and many of these properties are sold to hedge funds that control hundreds of thousands of homes, adding to or possibly causing all the inventory shortages in the U.S. The message here is simple. Besides TJ and I are highly qualified very active Realtors in Encanterra. Please reach out to us 1st before going down this easy out direct buy process. You will likely net more money and since this is such a unique property, selling or even buying through someone who is an expert in this community is a win/win for everyone.

and many of these properties are sold to hedge funds that control hundreds of thousands of homes, adding to or possibly causing all the inventory shortages in the U.S. The message here is simple. Besides TJ and I are highly qualified very active Realtors in Encanterra. Please reach out to us 1st before going down this easy out direct buy process. You will likely net more money and since this is such a unique property, selling or even buying through someone who is an expert in this community is a win/win for everyone.

Re-Post from: Collapse of the Real-Estate “Tech†IPO & SPAC Stocks: House Flippers Opendoor & Redfin Come Unglued, after Zillow

by Wolf Richter • Feb 26, 2022 • 71 Comments

“Tech†real-estate broker Compass and “tech†renters-insurance-seller Lemonade collapsed too. All eyes on “tech†mortgage-broker Better.com’s delayed SPAC deal. I can’t wait.

By Wolf Richter for WOLF STREET.

Even on Glorious Friday, the second day of a big rally after five days of sharp declines, the shares of a real-estate “tech†stock, house-flipper Opendoor, collapsed 23%, after having already collapsed in the months before.

Opendoor Technologies [OPEN], on Thursday evening, had reported a loss of $191 million for Q4, which brought its net loss for the year 2021 to $662 million, which brought its total losses for the four years that have been publicly disclosed to $1.5 billion. How can a house flipper lose $1.5 billion in four years? I don’t know either. But it isn’t over yet. And the company ended the year with an inventory of 17,009 unsold houses.

Opendoor went public in December 2020, at the IPO price of $31.47 amid enormous hoopla. By February 2021, shares had reached $39. If “February 2021†sounds familiar, it’s because that’s the month the stock market started coming unglued beneath the surface as highfliers started collapsing one at a time, each on its own schedule. The damage was such that I started reporting on it in May 2021. And this is just another chapter as it just keeps getting worse. On Friday, she shares closed at $8.44, down 78% from the February 2021 peak and 73% below its IPO price (data via YCharts):

Opendoor reported that it purchased 36,908 houses in 2021 but sold only 21,725 houses (for $8 billion) during the year, leaving it with 17,009 unsold homes ($6.1 billion) in inventory.

Opendoor financed this inventory with $6.1 billion in “non-recourse†debt backed by its houses. Non-recourse means if Opendoor defaults, its lenders get the house and cannot go after Opendoor’s other assets. If Opendoor cannot sell those homes and pay off the debt with the proceeds, it can hand the properties to the lenders and let them worry about selling the homes.

In addition, Opendoor was under contract to purchase 5,411 more homes for $1.9 billion.

About two-thirds of these 17,009 homes are finished and ready for resale. About one-third (about 5,500 homes) are “work-in-process†and are not for sale. Any of these 17,000 homes that haven’t been listed for sale, including all of the 5,500 homes that are work-in-process, are in the unknown pile of vacant homes that don’t show up in the official “supply†of homes and that don’t show up as vacant homes either.

Zillow did the same thing with a big portion of its 7,000 homes that were stuck in the pipeline before it quit the business last November and sold those homes mostly to institutional investors, who’re now trying to figure out what to do with them. These homes that are stuck in the house-flipper pipeline and that are shuffled around are vacant, but don’t show up as vacant, and they are not for sale, and don’t show up as “supply.â€

House-flipping is easy – the first part, buying the house, when money is no objective, and your algo can spend as much as it wants. The rest is hard, and making money at it is even harder, especially if you overpaid in the first place. The activity is not suited for people who write algos, it turns out.

Redfin, originally an online real estate broker, also rode up the algo-based house-flipper craze starting in 2020. And its shares [RDFN] rocketed higher amid endless hoopla by the crazed crowd of stock jockeys and hit a high of $98.44 in February 2021 – yup, that February again.

Then shares began their long collapse. On Friday, they closed at $21.83, having collapsed by 78% in one year. They’re now below where they’d been after the first day of trading following its IPO in July 2017:

Zillow [ZG] had a brief respite in its collapse when it announced on February 10 that it lost $881 million in 2021 on its home-flipping escapade, which came unglued in November 2021, when it disclosed that it would lay off 25% of its staff and get out of the house-flipping business, and dump the 7,000 homes it had bought.

Later it disclosed that it had sold most of these houses to institutional investors – rather than to people who might have wanted to live in them. Until those vacant houses are listed for sale they don’t show up in the official “supply,†and many of them may eventually show up on the rental market. And while all this is going on as they’re being shuffled around, they don’t show up as vacant either.

The $881 million loss was less than feared, and shares bounced magically over the following three trading days, but have since then given up a portion of it. On Friday, shares closed at $57.95, down 73% from their high a year ago, and about level with where they’d been in February 2020 before the crash:

Compass, a real-estate broker that calls itself “a tech company reinventing the space,†is one of those examples – one of very many – when you realize something is seriously wrong with Wall Street. But OK, people have fun with their trading apps, and if they get cleaned out, so be it.

Compass grew by using Softbank’s money, and the money of other investors, to buy up real estate brokerages around the country. Over the five years of publicly disclosed financial statements, Compass has lost $1.44 billion. How can a real estate broker in the red-hottest no-questions-asked housing market lose $1.44 billion? That was a rhetorical question.

Compass shares [COMP] peaked on their first day of trading, following the IPO in April last year, at $22.11 and have declined ever since. On Friday, they closed at $7.65, having plunged 65% in 10 months since the high on the first day of trading, and are now 58% below the IPO price of $18 a share:

Lemonade [LMND], which is hyped as an “insurance tech company†and sells insurance for renters, homeowners, pet owners, etc., went public in July 2020 at $29 a share and in the first day of trading, amid immense hoopla, spiked 139%. It then continued spiking until it reached $182 in January 2021. And then came said February 2021, when this whole show started unraveling.

On Friday, shares closed at $23.48, down 83% from the high, and 19% below the IPO price at which the shares never even traded because the first trade was at $50 a share, causing the tech stock pundits to lament how the company “mispriced†the IPO and how much money it “left on the table.†Yup, that’s how crazy this show was at the time.

Waiting for a share-price collapse is Better.com, a “tech†mortgage lender, backed by Softbank. It’s not yet a publicly traded stock because its merger with a SPAC was postponed in December 2021 after the CEO fired 900 employees, most of them in India, via a Zoom meeting that went viral, that idiot.

With the SPAC merger, and therefore the inflow of cash, having been delayed, the company raised $750 million from Softbank and its SPAC backers because, you know, these kinds of companies constantly burn large amounts of cash and constantly need new cash to burn.

So I’m looking forward to the moment the stock finally starts trading so I can add it to this list of collapsing real-estate “tech†stocks. This should be a goodie. So let’s hope that the merger with the SPAC goes through.