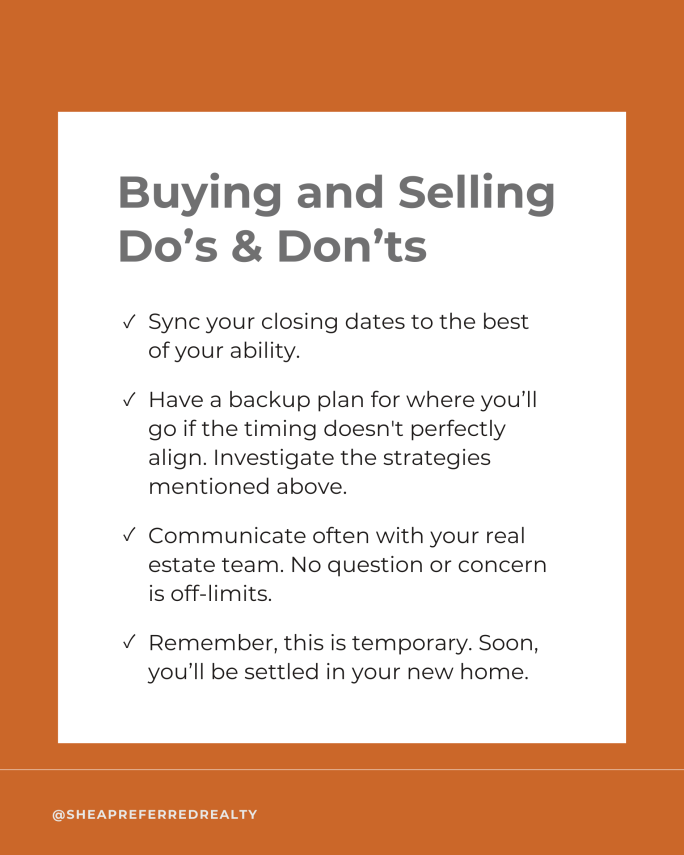

In a perfect world, buying and selling simultaneously would go according to schedule.

The reality is it doesn’t always pan out as nice and timely as you would like.

Thankfully, there are a few tricks and strategies you can utilize to smooth out any wrinkles in the plan.

1) Leasebacks – Leasebacks allow you to sell your home and then rent it back temporarily from the new owner.

It buys you time to find and close on your dream home without rushing or having to move twice.

2) Bridge loans – This type of loan acts as a temporary financing solution, bridging the financial gap between selling your current home and purchasing a new one. They often involve two phases.

Phase 1 – You may not have to make monthly payments on your new home, but interest accrues.

Phase 2 – Once your current home sells, you use the proceeds to pay off the bridge loan, including accrued interest.

Keep in mind a bridge loan can free you from the contingency of selling your current home before buying a new one.

If you’re planning to buy and sell at the same time, swipe for a few more dos and don’ts.

Want to Learn More About Buying & Selling? Send us a message and we will be happy to help! @Shea Preferred Realty Group